A good read —

The real reason for petrol and diesel price hikes https://bit.ly/3dskfUy

A good read —

The real reason for petrol and diesel price hikes https://bit.ly/3dskfUy

If social media is to be believed, today was a hard day for both option writers and option buyers. The price action moved with aplomb in both directions, mowing down stoplosses rather hungrily. Choppiness is evident in the charts; no doubt about it.

The upcoming RBI policy meet has brought in some profit booking in the BankNifty. Both indices have taken support of the 200EMA on the 5min timeframe. On the daily timeframe, the Nifty has support at the 200EMA, while the BankNifty has taken support at the 50EMA.

India VIX for today: 23.57 (−0.25 / -1.04%)

Check out the charts —

My actions and interpretations for today —

First (and only) trade: My initial entry point was at the virgin central pivot which would’ve been a strong resistance, but it was crossed. However, I could clearly see that the price action on the BankNifty had the next good resistance at the weekly (green) and monthly(yellow) pivots. Still, I watched the price action carefully before putting a short order at the 18th candle. Despite my care, I got stopped out of the trade.

Review: The consolidation continued to be choppy before the fall I was looking for finally occurred. I did not reenter the trade as sometimes the virgin central pivot tends to be a strong support/resistance depending which side the price action is and being stopped out made me a bit uncertain as to the market direction. It felt good to see that my view turned out right after all.

I was not idle. I pared off the long-term portfolio and increased my positional of the index. I have a long way to go in my study of price action. I’ve marked, as always, better entry and exit points. While hindsight puts everything in perspective in a more easier manner, I’m hoping to train my brain in recognizing certain patterns in the future that will help me in realtime.

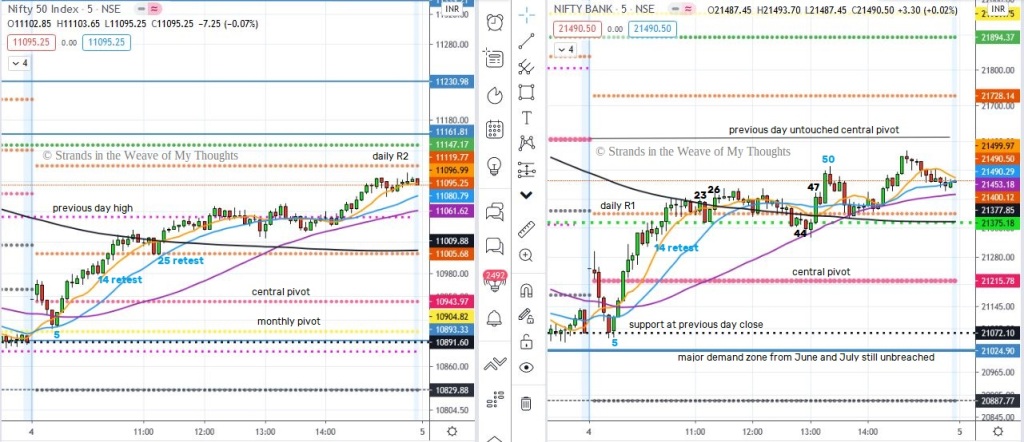

A good trending day from both indices, and to my relief, some decent pattern emergence once again from the charts. The price action in both indices bounced from the support zones made in previous trading sessions, confirming that the uptrend is still intact, at least for now.

The Nifty has made a decisive close above 11100 level, Reliance contributing heavily to this upmove.

Even the BankNifty has shown some bullishness on a higher timeframe, though not with the same exuberance as the Nifty. Today’s contribution came from RBL Bank and HDFC.

There was not a whole lot of choppiness visible in the Nifty, and VIX seems to have cooled down a bit. The BankNifty had its moments of sudden dives that kept me wary. I missed the initial uptrend because I expected some slight retracement that would provide me with a good entry point, but it was a while before I could do that.

India VIX for today: 23.82 (−1.37 / -5.44%)

Check out the charts —

My actions and interpretations for today —

First Trade: I put in a short trade at the 23rd candle on the BankNifty. The moment the 200EMA was breached upwards, I exited with some tiny profit just above my costs. It was clearly going to be a trending day.

Review: My only reason for a short trade was because the 200EMA seemed to be a firm resistance. I’ve not shorted the market in a long while, preferring positional cash trades at every dips. The confluence of MA at that point was rather confusing. Though initially there was some minimal profit, the candles soon took support at the daily R1 level, which I sensed and exited well before that.

Second Trade: The Nifty seemed to be consolidating, so I continued to watch the BankNifty and I finally went long at the 44th candle where it seemed to be supported by the MA. I rode the breakout candle and exited with decent profit.

Review: I exited earlier than planned, mainly because there are sudden large stoploss hunting candles that appear, and in this case there was a sudden reversal just a few candles after my exit, which could’ve wiped out all my gains. Nonetheless, a good trade.

Because the range had loosened a bit since yesterday, I went ahead and put in a trade or two. It felt good to get into the game. My entry and exit could’ve been better, but that is not always possible in live trades. In any case, I’ve marked candles (in blue numbering) where I could’ve entered and exited better for my study.

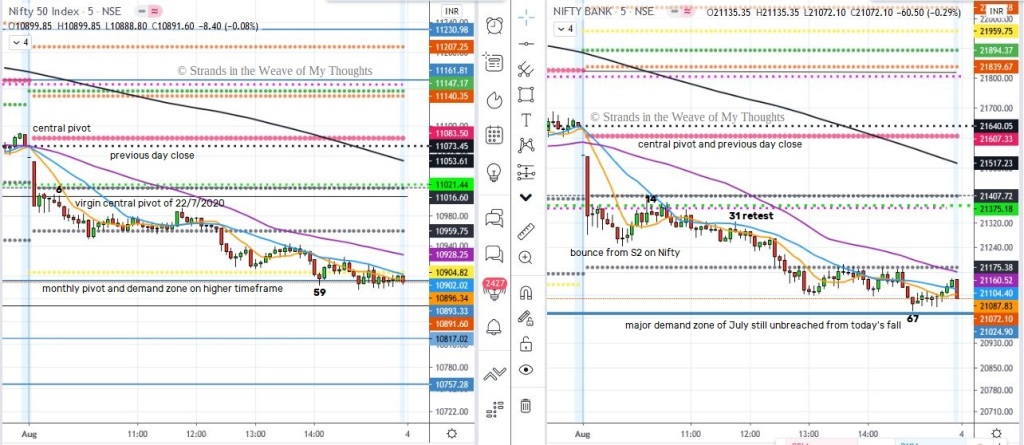

The day opened with a large red candle, signalling another bearish day. Both indices showed a downtrend, though the Nifty had more volatility. I was happy to see some pattern in today’s chart, which seemed missing over some sessions, with so many gap ups and severe volatility within tight ranges.

On the 1D timeframe, the Nifty is very close to the 200EMA where it seems to have taken support, though the next few days will give a clearer picture. With the fall over the past three trading sessions, most of the gaps that were formed during July’s uptrend have now closed up, except for the one formed on 2nd July (which is around 10440 levels and would require a fall of 500 points on the index to fill up; would that happen in the short-term?)

The BankNifty, on the other hand, has breached the 50EMA on the 1D timeframe; still it has continued to take a firm support at the 21000 level, which it has repeatedly retested in June and July. Consolidation is likely if this level remains unbreached. Again, the next few trading sessions will probably give a clearer picture.

Volatility seems to have slipped above 25 after lingering slightly below for sometime now.

India VIX for today: 25.18 (+0.99 / 4.10%)

Check out the charts —

My actions and interpretations for today —

No trade.

Review: I did actually put in a trade midmorning, but then canceled it because of the choppiness in the Nifty. Market direction has been so choppy and uncertain that I’ve been preferring positional trades lately, but I’ve marked a high probability trade for my study. BankNifty provided an easy trade today, and the range was reasonable. I’ll be on the lookout for more such patterns in coming sessions.

A day of consolidation after yesterday’s fall. The day opened with huge red bearish 1st candles for both indices, and the price action remained within this range for the rest of the day. In addition, for the Nifty, there was filling of the gap created on 20th July. Choppiness is evident in both charts.

India VIX for today: 24.19 (−0.54 / -2.16%)

Check out the charts —

My actions and interpretations for today —

No trade.

Review: Volatility within a tight range continues, which is keeping me away from intraday trades. I’ve marked a high probability trade on the Nifty, as part of my study. On higher timeframes, both indices have clearly taken support along the moving averages. The BankNifty has made a clear swing high and swing low for the entire month of July, visible on the 30min timeframe. I’ve continued with positional buying in Nifty50 during the last couple of falls.

Both indices showed a good selloff today, which seemed quite a likely event, because the Nifty seems to have approached a major resistance as mentioned yesterday. Despite this, on a higher timeframe, it appears the uptrend has not been breached as of now. So this corrective phase seems to be a paring off of some profit.

India VIX for today: 24.73 (+0.62 / 2.55%)

Check out the charts —

My actions and interpretations for today —

No trade.

Review: Today’s fall seemed a bit sudden, though the correction itself should not be surprising. There was no real bearish signs in the Nifty to signal the fall, while the BankNifty did show some small reversal candles near the swing high (though not as close to the swing high as I’d have wanted to see before entering a trade). I’ve been avoiding intraday postions due to the choppiness of the market and dubious patterns. Today’s doji candle opening meant that there was no decisive winning side. I’ve been adding to my positional trade in the indices during these corrections. Calmer markets is what I’m looking for, or at least some decent pattern for an intraday position.

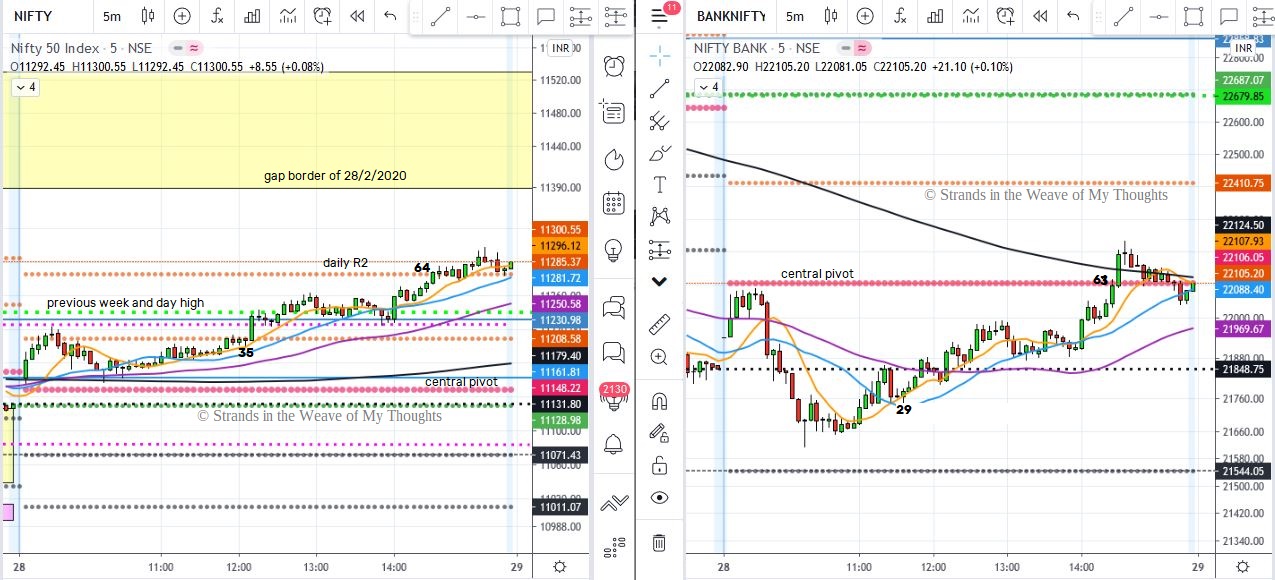

The Nifty50 has experienced a lot of choppiness today. The price action entered some correction today, but even with the slight fall, the index continues to take support at the moving averages on the larger timeframe. For now it appears the trend is intact. As an important zone, the price action is approaching a gap created by the 28th February opening, and may find some resistance here (spanning 11400 to 11500 levels).

The BankNifty is consolidating, still well within last week’s range. However, on the larger timeframe, although it has breached the faster moving averages, the 50EMA continues to offer support in its upward movement.

India VIX for today: 24.11 (+0.47 / 1.99%)

Check out the charts —

My actions and interpretations for today —

No trade. Review: The BankNifty was in too narrow a range. The Nifty was very choppy; still there was a possibility of trade which I've marked as a part of my study.

Finally a breakout on the Nifty. At every point I expected some failure of the breakout, especially during the consolidation in the early afternoon once the price action crossed the previous week’s and day’s highs; but it seems to have sustained this level to close at last above the daily R2, just at the 11300 level.

The BankNifty continued bearish until midmorning when it began a slow and steady rise, breaking above the central pivot to finally consolidate beneath the daily 200EMA, around the 22100 level.

India VIX for today: 23.64 (−1.38 / -5.50%)

Check out the charts —

My actions and interpretations for today —

No trade.

Review: Sometimes it’s best to do nothing until the direction is clear. I’ve marked possible entries and exits, just for my future reference. Tomorrow will be interesting.

Nifty continues to consolidate within a tight range of previous highs and lows. The BankNifty has shown a downtrend, breaking the previous weekly low level, and the intraday chart is showing bearishness.

India VIX for today: 25.02 (+0.48 / 1.97%)

Check out the charts —

My actions and interpretations for today —

No trade.