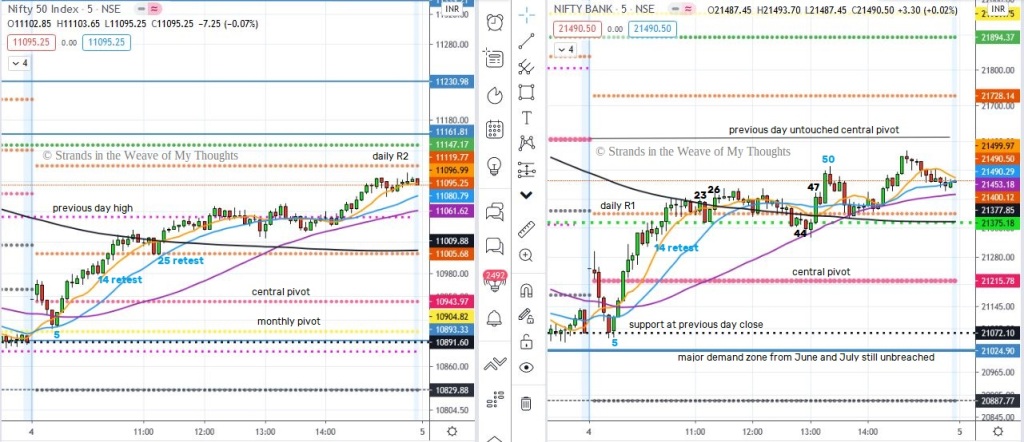

A good trending day from both indices, and to my relief, some decent pattern emergence once again from the charts. The price action in both indices bounced from the support zones made in previous trading sessions, confirming that the uptrend is still intact, at least for now.

The Nifty has made a decisive close above 11100 level, Reliance contributing heavily to this upmove.

Even the BankNifty has shown some bullishness on a higher timeframe, though not with the same exuberance as the Nifty. Today’s contribution came from RBL Bank and HDFC.

There was not a whole lot of choppiness visible in the Nifty, and VIX seems to have cooled down a bit. The BankNifty had its moments of sudden dives that kept me wary. I missed the initial uptrend because I expected some slight retracement that would provide me with a good entry point, but it was a while before I could do that.

India VIX for today: 23.82 (−1.37 / -5.44%)

Check out the charts —

- Nifty range: 10908.35 to 11110.50 (202.5 pts)

- Bank Nifty range: 21059.25 to 21574.30 (515 pts)

- Nifty50 Closing Advance/Decline Ratio: 32/17/1

My actions and interpretations for today —

First Trade: I put in a short trade at the 23rd candle on the BankNifty. The moment the 200EMA was breached upwards, I exited with some tiny profit just above my costs. It was clearly going to be a trending day.

Review: My only reason for a short trade was because the 200EMA seemed to be a firm resistance. I’ve not shorted the market in a long while, preferring positional cash trades at every dips. The confluence of MA at that point was rather confusing. Though initially there was some minimal profit, the candles soon took support at the daily R1 level, which I sensed and exited well before that.

Second Trade: The Nifty seemed to be consolidating, so I continued to watch the BankNifty and I finally went long at the 44th candle where it seemed to be supported by the MA. I rode the breakout candle and exited with decent profit.

Review: I exited earlier than planned, mainly because there are sudden large stoploss hunting candles that appear, and in this case there was a sudden reversal just a few candles after my exit, which could’ve wiped out all my gains. Nonetheless, a good trade.

Because the range had loosened a bit since yesterday, I went ahead and put in a trade or two. It felt good to get into the game. My entry and exit could’ve been better, but that is not always possible in live trades. In any case, I’ve marked candles (in blue numbering) where I could’ve entered and exited better for my study.