Complicated —

Author: dsbhat

A good read —

The real reason for petrol and diesel price hikes https://bit.ly/3dskfUy

Market Boom, Human Gloom

An interesting write-up in the NY times — Why Markets Boomed in a Year of Human Misery.

Bitcoin Rally

A good analysis on the Bitcoin rally — Why is Bitcoin Rallying?

Asset Class Performance

A good global review on the year gone by — How Every Asset Class, Currency and S&P500 Sector Performed in 2020.

Cochin Shipyard

Interesting articles on Cochin Shipyard Ltd —

Garware Technical Fibres

A good article on Garware Technical Fibres on Fortune India — Garware Casts its Net Wide.

Traded Waters

In mid September, CME Group, the world’s major derivative marketplace, and Nasdaq announced a new futures contract on Nasdaq Veles California Water Index (NQH2O). This is all in the name of “creating greater transparency, price discovery and risk transfer on the supply and demand of this vital resource”. The press release is available here — CME Group to Launch First-Ever Water Futures Based on Nasdaq Veles California Water Index.

The contract debuted last week and are so designed that no actual physical delivery of water takes place. Finshots has put out a detailed explanation of how this works in a financial sense. Do read the article here — The Californian Water Futures.

Needless to say, this has created some global concerns at the way water, a life-giving and life-sustaining resource, belonging to every living creature on this planet, is being traded like a commodity, such as gold or oil. The difference is clear — gold and oil can be held and traded without affecting the survival of the planet’s inhabitants right down to the microscopic level; however, without water there is no life, and making money off of this precious resource can make it hard for a major portion of life population to access water in its natural form. Initially it might be easy to keep contracts separate from the actual commodity itself, but in the long run there will be repercussions as water has become a dwindling resource. Hoarding the actual commodity can be a dangerous reality.

Some years ago I wrote a post on the water trade becoming a reality. Do read it here — A Price on our Waters.

It is a serious point to ponder.

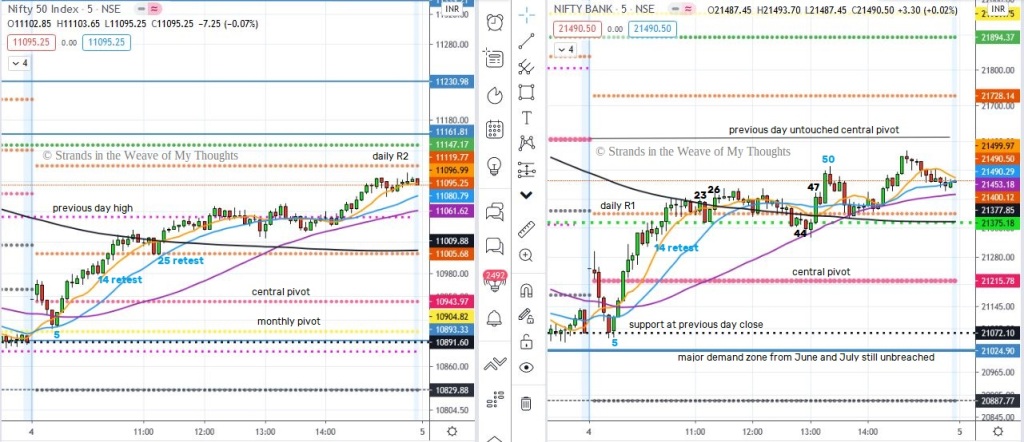

Trade Day 05.08.2020

If social media is to be believed, today was a hard day for both option writers and option buyers. The price action moved with aplomb in both directions, mowing down stoplosses rather hungrily. Choppiness is evident in the charts; no doubt about it.

The upcoming RBI policy meet has brought in some profit booking in the BankNifty. Both indices have taken support of the 200EMA on the 5min timeframe. On the daily timeframe, the Nifty has support at the 200EMA, while the BankNifty has taken support at the 50EMA.

India VIX for today: 23.57 (−0.25 / -1.04%)

Check out the charts —

- Nifty range: 11224.95 to 11064.90 (-160 pts)

- Bank Nifty range: 21936.50 to 21448.45 (-488 pts)

- Nifty50 Closing Advance/Decline Ratio: 35/15

My actions and interpretations for today —

First (and only) trade: My initial entry point was at the virgin central pivot which would’ve been a strong resistance, but it was crossed. However, I could clearly see that the price action on the BankNifty had the next good resistance at the weekly (green) and monthly(yellow) pivots. Still, I watched the price action carefully before putting a short order at the 18th candle. Despite my care, I got stopped out of the trade.

Review: The consolidation continued to be choppy before the fall I was looking for finally occurred. I did not reenter the trade as sometimes the virgin central pivot tends to be a strong support/resistance depending which side the price action is and being stopped out made me a bit uncertain as to the market direction. It felt good to see that my view turned out right after all.

I was not idle. I pared off the long-term portfolio and increased my positional of the index. I have a long way to go in my study of price action. I’ve marked, as always, better entry and exit points. While hindsight puts everything in perspective in a more easier manner, I’m hoping to train my brain in recognizing certain patterns in the future that will help me in realtime.

Trade Day 04.08.2020

A good trending day from both indices, and to my relief, some decent pattern emergence once again from the charts. The price action in both indices bounced from the support zones made in previous trading sessions, confirming that the uptrend is still intact, at least for now.

The Nifty has made a decisive close above 11100 level, Reliance contributing heavily to this upmove.

Even the BankNifty has shown some bullishness on a higher timeframe, though not with the same exuberance as the Nifty. Today’s contribution came from RBL Bank and HDFC.

There was not a whole lot of choppiness visible in the Nifty, and VIX seems to have cooled down a bit. The BankNifty had its moments of sudden dives that kept me wary. I missed the initial uptrend because I expected some slight retracement that would provide me with a good entry point, but it was a while before I could do that.

India VIX for today: 23.82 (−1.37 / -5.44%)

Check out the charts —

- Nifty range: 10908.35 to 11110.50 (202.5 pts)

- Bank Nifty range: 21059.25 to 21574.30 (515 pts)

- Nifty50 Closing Advance/Decline Ratio: 32/17/1

My actions and interpretations for today —

First Trade: I put in a short trade at the 23rd candle on the BankNifty. The moment the 200EMA was breached upwards, I exited with some tiny profit just above my costs. It was clearly going to be a trending day.

Review: My only reason for a short trade was because the 200EMA seemed to be a firm resistance. I’ve not shorted the market in a long while, preferring positional cash trades at every dips. The confluence of MA at that point was rather confusing. Though initially there was some minimal profit, the candles soon took support at the daily R1 level, which I sensed and exited well before that.

Second Trade: The Nifty seemed to be consolidating, so I continued to watch the BankNifty and I finally went long at the 44th candle where it seemed to be supported by the MA. I rode the breakout candle and exited with decent profit.

Review: I exited earlier than planned, mainly because there are sudden large stoploss hunting candles that appear, and in this case there was a sudden reversal just a few candles after my exit, which could’ve wiped out all my gains. Nonetheless, a good trade.

Because the range had loosened a bit since yesterday, I went ahead and put in a trade or two. It felt good to get into the game. My entry and exit could’ve been better, but that is not always possible in live trades. In any case, I’ve marked candles (in blue numbering) where I could’ve entered and exited better for my study.